indiana estate tax form

The final income tax. Federal Form 1041 US.

Instructions include rate schedules.

. The decedent and their estate are. PROPERTY TAX BENEFITS State Form 43708 R15 1-20 Prescribed by the Department of Local Government Finance COUNTY TOWNSHIP YEAR File Mark. Indiana Current Year Tax Forms.

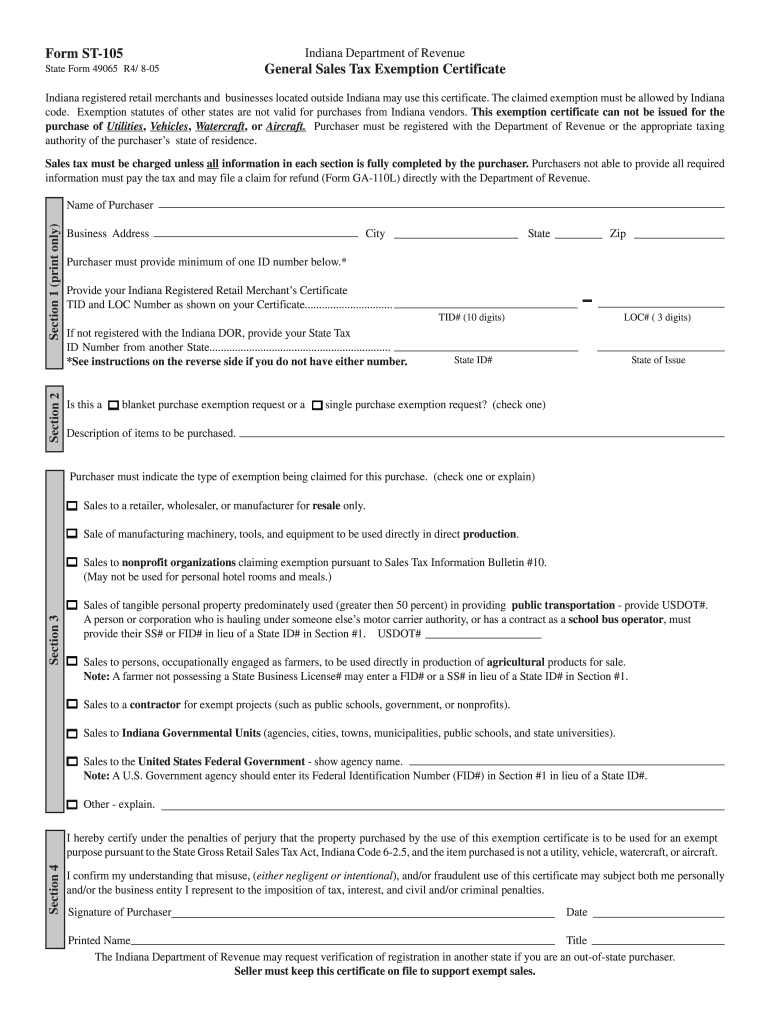

Sales Disclosure Form 46021 or State Form 18865. Try it for Free Now. Ad Download or Email IRS 706 More Fillable Forms Register and Subscribe Now.

These taxes may include. If you need to contact the IRS you can access. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Therefore you must complete federal Form 1041 US.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

If you need to contact the IRS you can access its website at wwwirsgov. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. Ad Download Or Email Probate More Fillable Forms Register and Subscribe Now.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Sales Disclosure Form 46021 or State Form 18865 and Indiana Department of. IRS Form 1041 US.

Use e-Signature Secure Your Files. Upload Modify or Create Forms. Form 46021 or State Form 18865.

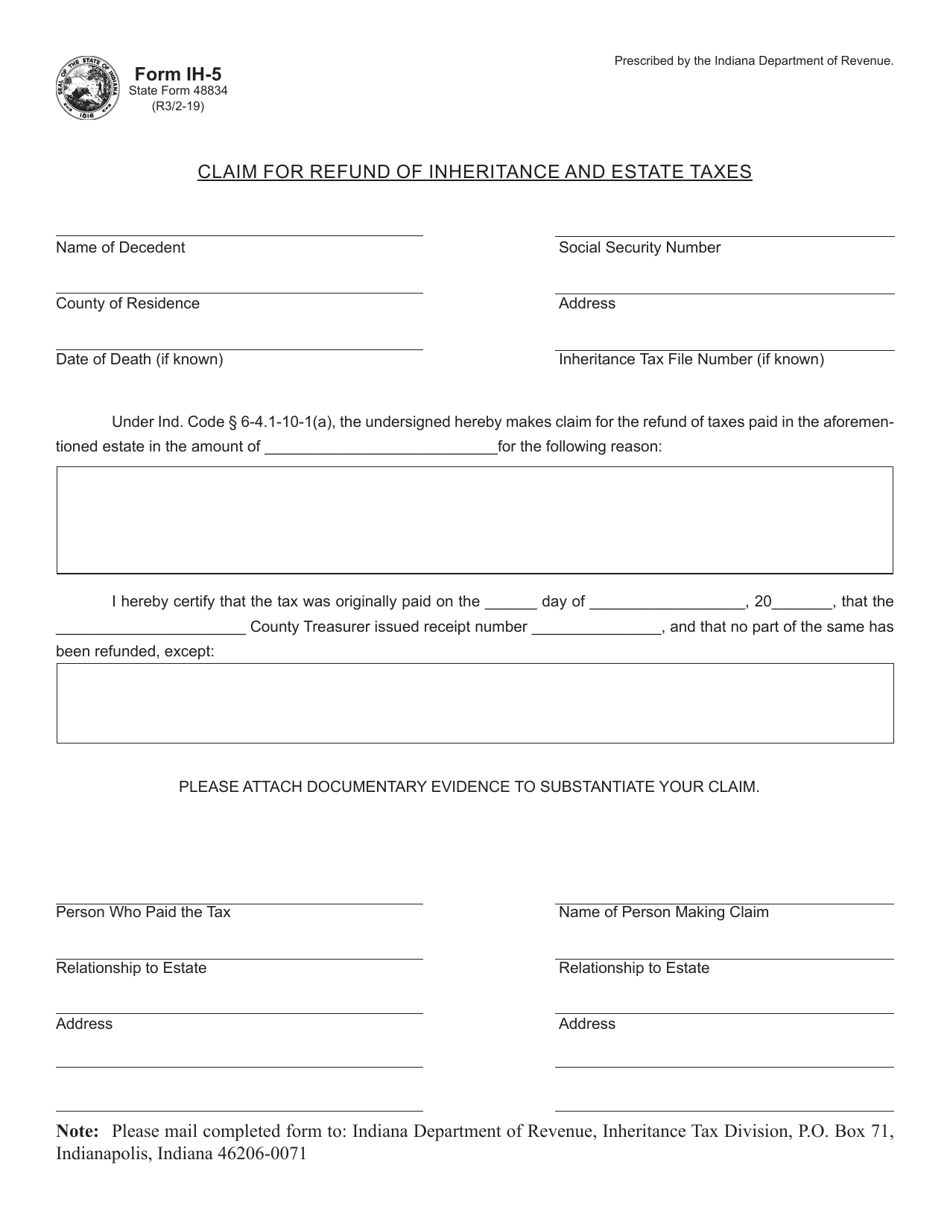

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Printable Indiana state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Federal tax forms such as the 1040 or 1099 can be found. All Indiana real property for the.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. The Indiana income tax rate for. Inheritance tax was repealed for individuals dying after Dec.

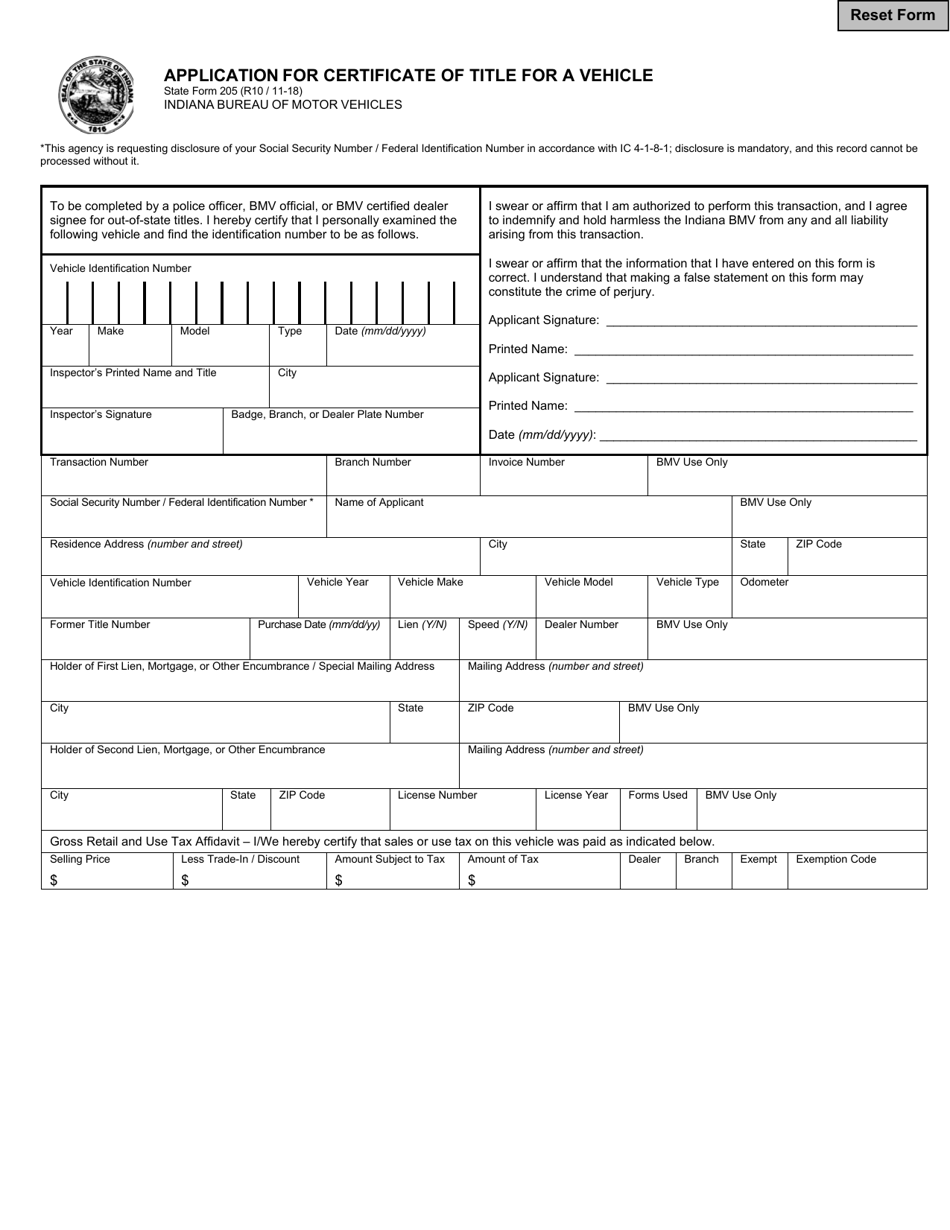

Form 706 is used by the executor of a decedents estate to figure the estate tax imposed by Chapter 11 of the Internal Revenue Code.

Wisconsin Quit Claim Deed Form 3 2003 Being A Landlord Quites The Deed

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Indiana Quit Claim Deed Form Qcd 1 Quites Indiana The Deed

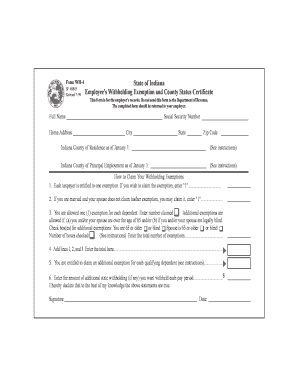

Indiana W4 Fill Online Printable Fillable Blank Pdffiller

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

State Death Tax Hikes Loom Where Not To Die In 2021

State Form 205 Download Fillable Pdf Or Fill Online Application For Certificate Of Title For A Vehicle Indiana Templateroller

Free Indiana Small Estate Affidavit Form Pdf Word Template Sample Resume Format Letter Addressing Power Of Attorney Form

Indiana W4 Pension Form Fill Online Printable Fillable Blank Pdffiller

Washington Quit Claim Deed Form Quites Washington Sheet Music

16 Printable Indiana State Tax Withholding Form Templates Fillable Samples In Pdf Word To Download Pdffiller

/writing-hand-pen-money-office-math-699519-pxhere.com1-689d978232b349a0b997494f7d98728a.jpg)